Why is Facebook charging for an ad-free experience, and what does that mean for advertisers?

What the ad-free Facebook and Instagram experience means for advertisers

You might not know about it until the notification pops up on your account, but in September it was quietly announced that Meta will be starting to offer an ad-free Facebook and Instagram experience – for a fee, of course.

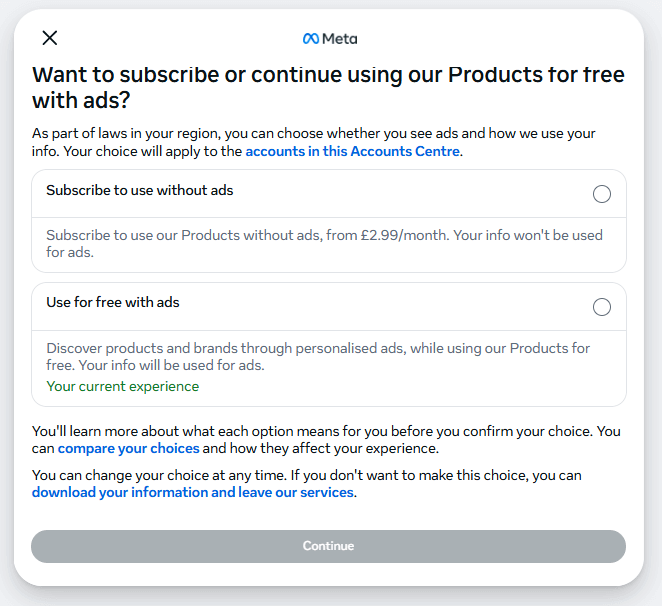

Image: ad choice pop up in the Facebook desktop site

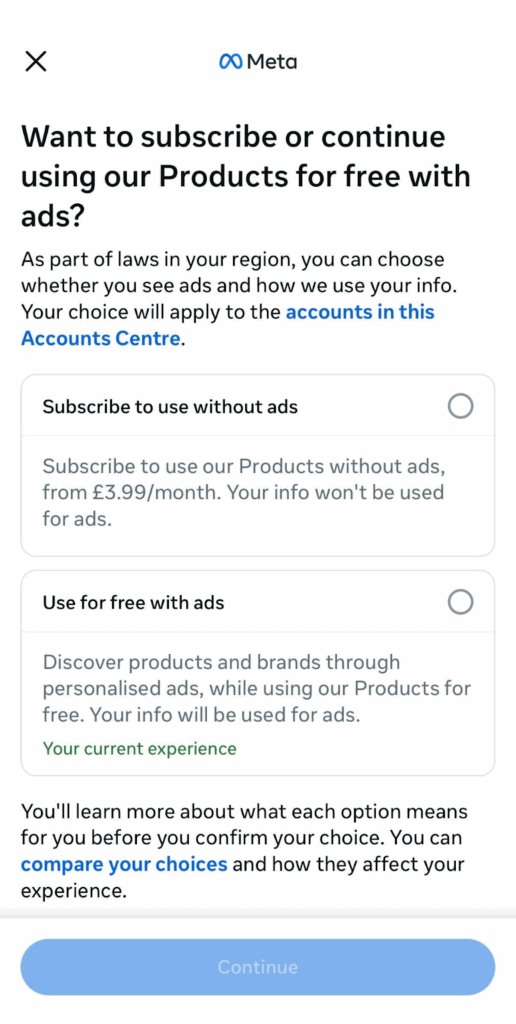

At £2.99 a month for web users, or £3.99 a month for app users due to app store cuts, it’s one of those “less than the price of a cup of coffee” fees which have been popping up across the web, particularly for news publishers.

A similar version has been running in the EU for a few months, although it’s a little more costly there and comes with an additional “less personalised ads” option. This is due to stricter data privacy rules being enforced by EU regulators, which require explicit consent before personal data can be used for targeted ads.

Why is Meta rolling out a subscription model?

As is often the case for tech giants and privacy, this change was prompted by legal action and pressure from regulators.

In the EU, the Digital Markets Act and its associated privacy rules pushed Meta to rethink how it uses personal data. In the UK, a human rights campaigner won a GDPR-based legal challenge against Meta’s data collection practices.

The resulting “pay or consent” model is still being debated and tested for both Meta and other providers, but we can expect there to be some kind of payment option in place going forward. Currently it doesn’t seem that UK regulators will be pushing for the same strict privacy and consent rules as the EU has enforced.

What an ad-free Meta might mean for the advertising industry

Meta runs on advertising dollars. An ad-free experience replaces that revenue with subscription fees, and even if those fees make up the shortfall for Meta, advertisers will lose out.

At the same time, Meta gains clearer consent from users who choose the “free with ads” option. That could allow it to expand how it targets those remaining users, especially as automation tools like Advantage+ are taking an increasing role in optimising performance.

And remember, your feed isn’t only filled with paid placements. Organic content from brands and creators still plays a major role in how users engage on social platforms, much of it less relevant than carefully targeted paid ads. Feeds might be paid ad free, but they’ll never be the friends-only content of the early heydays; the engagement machine still needs to keep you scrolling.

Image: ad choice pop up in the Facebook app

The overall impact on advertisers will depend on how many people decide to pay and who they are. Meta hasn’t published official numbers on the similar EU approach, but industry feedback suggests fairly limited numbers are opting to pay, with most people preferring the free experience.

Even if a small proportion of users subscribe, with fewer users seeing ads the available ad inventory will shrink. A smaller ad space means a more competitive auction, which means higher costs as brands fight to remain visible. Advertiser bidding and targets have to be adjusted based on new CPCs, which might mean pulling back on spend to maintain CPA or ROAS.

If the paid tier skews toward higher-income users, as seems likely, premium brands could feel the pinch most. But that disposable income doesn’t disappear, it just becomes harder to reach through paid ads on Meta. We would expect to see more budget diversification across other channels and particularly into influencer and partnership content, which can still appear in ad-free feeds.

These privacy-conscious users might already be declining cookies everywhere, so current targeting methods may be inefficient, with channels needing to model these interactions on limited data. With these users being unlikely to click or convert, we may even see their absence from Meta’s ad pool improve efficiency.

Finally, the EU-only ‘less precisely targeted’ ad experience has its own costs, as weakened targeting tends to lead to declining conversion rates, pushing advertisers to cut their bids to compensate. No sign of this yet in the UK, but regulators will be watching EU developments.

It’s not going to signal the end of paid ads on Meta. Advertising is too big an earner for that. But advertisers are going to have to adapt how they target, price and run their Meta campaigns, especially as the fees roll out just in time for the peak retail season.

What we’re doing about it

Automation is key. Leaning into Meta’s Advantage+ algorithm-based targeting and creative selection, we’ve seen lower costs and stronger conversion rates, all with reduced manual management. This is only going to become more important as the auction fluctuates in the next few weeks and months.

Get your organic content in order. Not only is this becoming more important for driving visibility in the age of AI overviews, it allows your most dedicated customers to react, repost and repurchase, pushing your brand into that all-important feed. Influencer or partnership content might become more powerful and get you the reach that you can’t manage from even the most exciting of organic posts.

If your targeting is solid and your creative stands out, you’ll weather the changes just fine. And if you’d like a hand navigating the transition, get in touch.

And if you don’t like the idea of paying £3.99 / month for your great-aunt Ethel’s AI-generated recipe reposts, this might be the sign you need to delete the apps and cut down your time spent doom-scrolling.