SEO News Round Up – October 2024

We’ve pulled together all the news you need to know on what’s been happening with Google, and search more generally, in October – so you can keep up to date!

Covering:

- OpenAI’s Search GPT launch: a real rival to Google?

- Perplexity AI’s $500M funding push to reach $8B valuation: a true challenger to ChatGPT?

- Semrush acquires Search Engine Land

- Google and Bing report significant YoY growth in search advertising revenue

OpenAI’s Search GPT launch

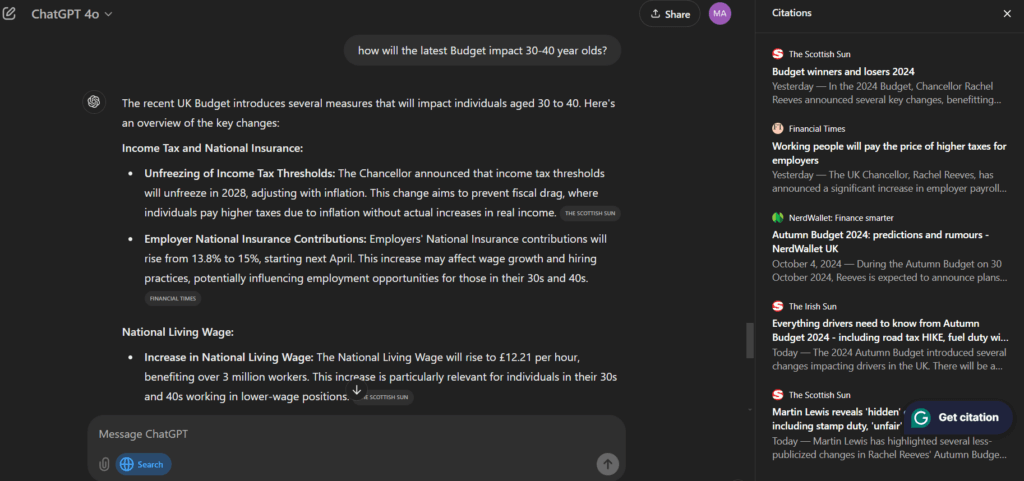

On 31st October, OpenAI announced the launch of Search GPT/ChatGPT search—the integration of real-time web search capabilities into ChatGPT, marking a significant advancement in AI-driven search technology. This update enables ChatGPT to access and retrieve up-to-date information (no more lag) from the internet, providing users with more accurate and relevant answers. It is currently available to Paid (Plus) users and those who signed up to the waitlist.

Key features of ChatGPT’s enhanced search functionality:

- Real-time information access: ChatGPT can now fetch current data, including latest news, sports, weather forecasts, etc.

- Interactive responses: it now delivers interactive elements such as graphs, maps, and cited articles, enhancing usability. From a quick play around, the images it surfaced for me were far fewer (3-5) but better matched what I was looking for than a typical Google image results page.

- Source citations: it cites more than the Google’s AIO does and is much more visible with its sharing of web content. This is a clever move, as common feedback regarding AI content is ‘can it be trusted?’, so it makes sense for data sources to be as visible as possible. OpenAI has invested a lot of money into partnerships with some of the world’s largest news publishers over the last year – including The Associated Press, Reuters, Axel Springer, Condé Nast, Hearst, Dotdash Meredith, the Financial Times, News Corp., Le Monde, The Atlantic, Time and Vox Media – so this is perhaps not surprising.

- See a screenshot below, note the interesting mix of citations on the right:

So what does this mean for Google and search in general?

This development positions ChatGPT as a direct competitor to established search engines like Google, Microsoft’s Bing and ‘upstart’ Perplexity, offering a more conversational and interactive alternative for information retrieval.

CEO Sam Atlman recently said he’s not a fan of the ad-driven revenue model traditionally used by search and prefers simply charging for use of the platform, arguably providing a better experience for users.

The data is constantly changing but recent figures state ChatGPT now has over 200 million weekly active users, doubling from last November, and 92% of Fortune 500 companies are now using its products. For comparison, 155 billion searches are made each week on Google (user data is unavailable).

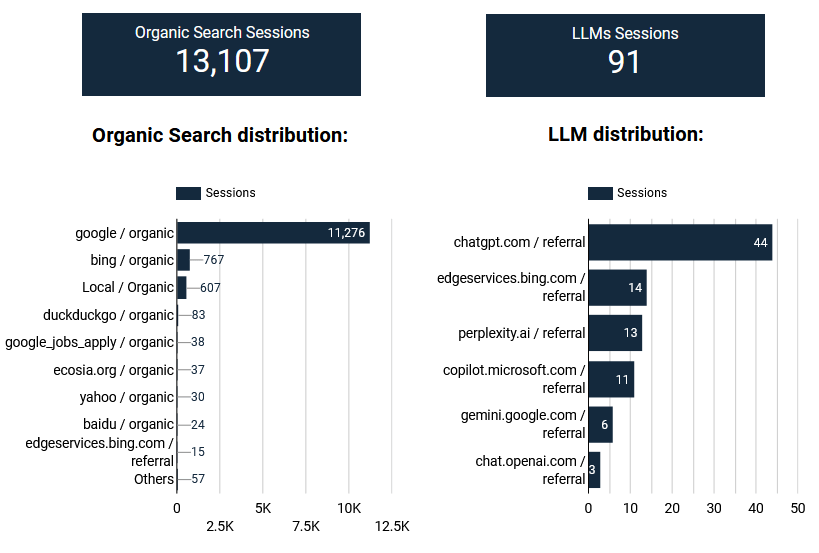

Below is the current ratio of Organic vs LLM traffic Distinctly’s website receives to provide an idea of how the platforms perform for us:

While the launch of Search GPT is a significant advancement in AI-driven search, Google’s deep-rooted cultural presence and substantial head start mean that any meaningful shift will take time. However, it’s worth noting that we continue to observe consistent increases in AI and LLM referral traffic across 90% of our clients, signalling a gradual shift in user behaviour and the growing influence of these technologies. We will be watching with interest over the coming months.

Perplexity AI pursues $500M funding to elevate valuation to $8B

Perplexity AI, an AI-driven search engine startup backed by Jeff Bezos and NVIDIA, is in discussions to secure $500 million in new funding, aiming to boost its valuation to approximately $8 billion.

This move follows a previous funding round in June 2024 that valued the company at $3 billion. ChatGPT is valued at $157 billion, for comparison.

The anticipated investment is expected to enhance Perplexity AI’s competitive stance against industry leader OpenAI’s ChatGPT.

Semrush acquires Search Engine Land

While it may not make waves outside SEO circles, this news was significant – and unexpected – for those of us in the industry.

Semrush are one of the top 2 SEO platforms on market – the other being Ahrefs. They went public on Nasdaq in 2021 whereas Ahrefs have stayed independent. Their marketing strategies are known for being particularly bold, and they have previously ruffled feathers in the community. Notable actions include:

- Offering paid guest blogging services within its platform against Google’s guidelines.

- Lack of content neutrality on previous media acquisitions post-purchase.

- Heavy usage of influencer marketing that some perceive as overreaching.

Search Engine Land is one of the longest-running and respected search-based publications, so to see it bought by a tool provider was surprising, however hardly an uncommon tactic for businesses looking for better marketing coverage and distribution.

This great chart by Carl Hendy reveals just how impactful this acquisition could be, highlighting that Semrush now controls 16% of the share of voice within the informational SEO space. This chart underscores the tool’s growing influence and how this may shape narratives within the industry moving forward.

Google and Bing report significant YoY growth in search advertising revenue

In their recent earnings reports (29th and 30th October), both Alphabet (Google’s parent company) and Microsoft highlighted significant developments in search advertising revenues.

Alphabet (Google):

- Overall Performance: In Q3 2024, Alphabet reported a 15% year-over-year increase in revenue, reaching $88.3 billion. Net income rose by 33.6% to $26.3 billion.

- Search Advertising Revenue: Google’s search advertising revenue grew by 12% to $49.39 billion, surpassing growth expectations, particularly amid the backdrop of ‘the rise of AI Chat’. This increase is attributed to the successful integration and implementation of AI Overviews into the everyday browsing experience, which is improving weekly. Google still has a 90% search engine market share globally, down from 91.6% a year ago according to recent Stat Counter data.

- They also say:

- They’ve reduced the costs of AIOs by 90% over the last year.

- People who use AIOs come back to search more often.

- More than a quarter of new code at Google is AI-generated.

Microsoft:

- Overall Performance: In Q3 2024, Microsoft reported strong overall earnings, with total revenues of $65.59 billion (up 16% YOY).

- Search and Advertising Revenue:

- Microsoft’s advertising revenue, which includes Bing Search Ads, rose by 10% YOY.

- Microsoft has credited its advertising revenue growth to AI-powered advancements, which have improved ad delivery and user engagement.

- Bing’s ad revenue has benefitted from these AI improvements, which make the platform more appealing to advertisers due to more effective ad targeting.

What does this mean for marketers?

Businesses always need to be visible where their audience spends time online, and for the vast majority of people, Google is the place where searches start.

Bing is the default search engine browser on all Microsoft products and devices, and Linkedin is used by over 140 million professionals daily so has a huge reach for advertisers.

Increased ad revenues come from more business investment which push cost-per-clicks up higher. So whilst it is necessary for businesses to be visible across as many key online touchpoints as possible, it is important to note that only 1.4% of searches that result in a click on Google go to an ad, so the importance of ranking highly organically is critical for success.

Stay Ahead in SEO with Distinctly

Enjoyed our October SEO roundup? Stay updated with the latest SEO trends, tips, and exclusive insights by subscribing to our newsletter.